Car insurance discounts: how to save money on your premiums

Car insurance is a necessity for drivers in the United Kingdom, but it can also be a significant expense. Fortunately,

Compare quotes in minutes and you could save up to £518*

Enter a few details about what you are looking for.

Save money by comparing instant quotes online.

You can then apply online and your application will be processed directly by the car insurance provider.

You are required to have car insurance in the UK if you own or drive a motor vehicle on public roads. The minimum level of insurance required in the UK is known as “third-party insurance.”

Driving without insurance in the UK is a serious offence. If you’re caught without insurance, you could face fines, penalty points on your driving license, and even having your vehicle seized and crushed.

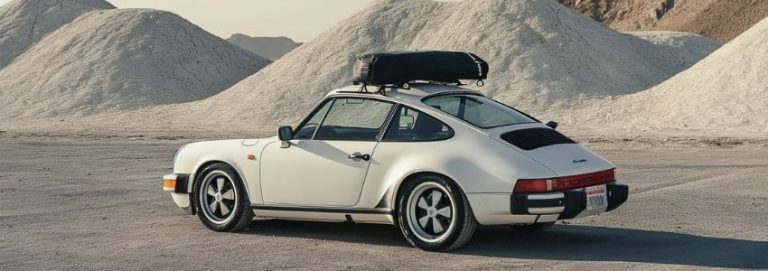

Consider the make, model, age, and value of your vehicle when purchasing a car.

Improve the security of your vehicle by installing anti-theft devices, alarms, immobilisers, and tracking systems.

Consider where you park your car overnight.

Opt for a higher voluntary excess if you can afford it.

Pay for no-claims bonus protection and maintain your no-claims discount even if you make a claim.

If possible, add an experienced and low-risk driver to your policy, such as a spouse or parent.

Consider black box insurance, where your driving behaviour is monitored.

If you can afford it, pay your premium annually instead of monthly.

Don't automatically renew your policy without comparing quotes.

This is the minimum legal requirement. It covers liability for injury or damage to other people and property caused by your vehicle.

In addition to third-party coverage, TPFT insurance also covers your vehicle if it’s stolen or damaged by fire.

Comprehensive insurance covers you if you damage your car, somebody else’s car or if you injure somebody in an accident, regardless of who’s at fault. It also covers your vehicle if it’s damaged by fire or stolen.

Telematics insurance involves the use of a black box device installed in your vehicle or a smartphone app to monitor your driving behaviour.

PAYG insurance allows you to pay for coverage only when you’re using your vehicle. It’s often used by occasional drivers and can be a cost-effective option.

Multi-car insurance allows you to cover multiple vehicles and drivers under a single policy.

Temporary car insurance provides coverage for a short duration, typically from one day up to a few months.

If you use your vehicle for business purposes, you may need commercial car insurance.

The price of car insurance in the UK is influenced by various factors that insurance providers consider when calculating premiums, including:

Car insurance is a necessity for drivers in the United Kingdom, but it can also be a significant expense. Fortunately,

Car insurance is a legal requirement for drivers in the UK, but it doesn’t have to break the bank. With

Car insurance is a legal requirement in the United Kingdom, and it’s essential for protecting yourself and others on the