Compare learner drivers insurance quotes

Compare quotes in minutes and you could save up to £518*

- Compare quotes from over 120+ UK providers

- You could save up to £518 on car insurance [1]

- Enjoy a year of savings from over 300 brands with MoneySpider Premium Rewards when you purchase a policy [2]

Why compare car insurance

Compare car insurance quotes online and you could start saving today.

You can compare learner drivers insurance from the UK's biggest brands

Register with MoneySpider and join our exclusive rewards club that can save you up to £1,800 a year from over 300 high street brands, including major supermarkets!

What to consider with learner driver insurance

Before taking out a policy, it’s worth thinking about how you’ll be using the car and what level of cover you need. Some learner insurance is available on a short-term basis — perfect if you’re learning quickly or only need cover during school holidays. Others can last up to 12 months, giving more flexibility for those taking their time.

You should also check whether your policy includes driving with a supervising driver outside of lessons, and if there are restrictions on the car you’ll be practising in. Always make sure the supervising driver meets the legal requirements.

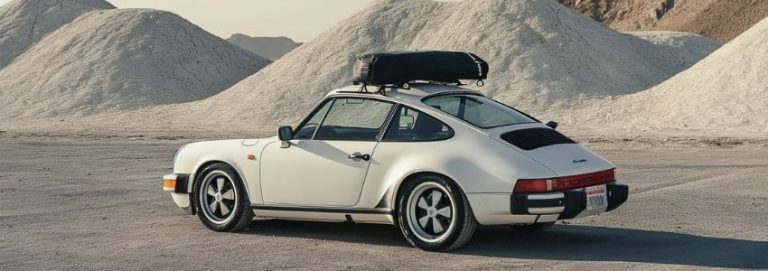

What to consider before choosing classic car insurance

Classic car policies can vary significantly between insurers, so it’s important to think about how you use your vehicle and what you want covered. If your car is primarily for leisure use, you may benefit from limited mileage policies. On the other hand, if your vehicle is undergoing restoration, you may want cover that includes parts and work in progress.

It’s also worth checking whether your policy provides agreed value cover, as relying on market value alone may not reflect the true worth of your vehicle. Storage arrangements, such as keeping your car in a secure garage, can also impact both eligibility and price.

Types of learner drivers insurance

This is the minimum legal requirement. It covers liability for injury or damage to other people and property caused by your vehicle.

In addition to third-party coverage, TPFT insurance also covers your vehicle if it’s stolen or damaged by fire.

Comprehensive insurance covers you if you damage your car, somebody else’s car or if you injure somebody in an accident, regardless of who’s at fault. It also covers your vehicle if it’s damaged by fire or stolen.

Telematics insurance involves the use of a black box device installed in your vehicle or a smartphone app to monitor your driving behaviour.

PAYG insurance allows you to pay for coverage only when you’re using your vehicle. It’s often used by occasional drivers and can be a cost-effective option.

Multi-car insurance allows you to cover multiple vehicles and drivers under a single policy.

Temporary car insurance provides coverage for a short duration, typically from one day up to a few months.

If you use your vehicle for business purposes, you may need commercial car insurance.

Factors that affect learner driver insurance premiums

Your age

Younger drivers often pay more as they’re statistically higher risk.

Type of car

Small, low-powered cars are usually cheaper to insure for learners.

Policy length

Short-term policies may have a higher daily cost than longer-term ones.

Location

Where you live and keep the car can influence your premium.

Driving history

If you already hold a provisional licence and have some experience, this can affect the price.

Get on the road with learner driver insurance

Learning to drive is an exciting step, but it can also be expensive, especially if you’re relying solely on lessons. Learner driver insurance gives you the freedom to practise in a friend’s or family member’s car, without risking their no-claims bonus. It’s a flexible and affordable way to build up confidence on the road before your driving test.

At MoneySpider, we make it easy to compare learner driver insurance quotes from trusted UK providers, helping you find cover that works for your situation and budget.

Advice for learner drivers considering insurance

Learner driver insurance can be a cost-effective way to get extra practice outside of formal lessons. To get the most out of it, plan your practice sessions with a qualified supervisor in advance and focus on different types of roads and conditions. Building a range of experience before your test can boost your confidence and help reduce nerves on the big day.

If you’re using someone else’s car, remember to double-check the policy terms so their no-claims bonus is protected. And don’t forget: consistency is key, regular practice often leads to quicker progress, potentially saving you money on lessons overall.

FAQ

Need more help?

Can I get learner driver insurance on my own car?

Will practising in a family member’s car affect their insurance?

Can I drive alone with learner driver insurance?

Is short-term learner driver insurance available?

Will learner driver insurance count towards my no-claims bonus?

Helpful guides & articles

How you could save money on your car insurance

Car insurance is a legal requirement for drivers in the UK, but it doesn’t have to break the bank. With

Car insurance discounts: how to save money on your premiums

Car insurance is a necessity for drivers in the United Kingdom, but it can also be a significant expense. Fortunately,

Types of car insurance coverage: what do you really need in the UK

Car insurance is a legal requirement in the United Kingdom, and it’s essential for protecting yourself and others on the